RESPs still misunderstood as a vehicle to save for education costs

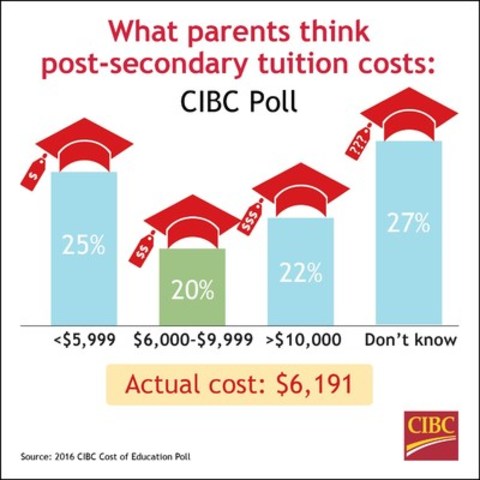

TORONTO, Sept. 1, 2016 /CNW/ - While eight out of 10 Canadian parents claim they have a good understanding of the costs associated with a post-secondary education, a new CIBC poll (TSX: CM) (NYSE: CM) finds that almost 75 per cent don't really seem to grasp the actual cost of tuition. What's more, almost 40 per cent admit they don't know what to budget for their children's non-tuition costs, such as books, accommodation and living expenses.

"Our poll finds that most parents are unaware of the real costs of their children's post-secondary education," says Kathleen Woodard, Senior Vice President, Retail and Business Banking, CIBC. "It's stressful when you don't know if you are on the right track or not. Have I saved too much, too little or just enough? Many parents think they know what to expect, but end up being surprised at the true cost. That makes it hard to budget and build a savings plan."

Key poll findings include: "With parents not really knowing what the costs are, it's not surprising that so many students end up treating their parents like ATMs once they're in school," says Ms. Woodard. A CIBC poll in August 2015 found that more than half of post-secondary students tapped their parents for additional financial support while at school because they ran out of money. Parents regret not saving earlier

The poll also finds that 39 per cent of parents with children enrolled or recently graduated say it cost them more than expected, while almost half (46 per cent) said in hindsight, they should have started saving earlier.

"When you're looking at a total cost over four years of at least $100,000 for one child who goes away to college or university, that's a major investment ahead," says Ms. Woodard. "It's important to prioritize financial obligations – be it saving for a child's education, paying down the mortgage, saving for retirement, going on a family vacation or buying a cottage – and that's where expert advice can really help from how to budget and find savings to investing your money prudently."

The best school supply is an RESP – but many parents lack basic knowledge

While 76 per cent of parents saving for their children's post-secondary school education have set up a Registered Education Savings Plan (RESP), many lack fundamental knowledge about RESPs: "It's never too late to start contributing to a RESP," says Ms. Woodard. "Even if you skip a year or five years of putting money into the RESP, there are opportunities to benefit from the government grant. It's certainly money that you don't want to leave on the table. That extra $500 grant per year might be the difference of whether your child works part-time during school or can focus solely on their studies."

Here are five hacks for parents:

1. Start early

2. RESP contributions can be made until children reach age 31

3. Explore all government grants - Federal and various provincial governments have incentives for education savings that are administered through RESPs.

4. Set financial priorities & map out how to achieve them

5. Talk to a qualified expert - know the RESP rules, limits, over contribution penalties and map out an investing and withdrawal strategy.

The survey captured the views of parents either sending their children to post-secondary school for the first time this year or plan to in the future, or have children who are currently enrolled or have completed their matriculate education.

KEY POLL FINDINGS:

Overall understanding of the total cost of post-secondary education:

|

Good or very good understanding |

81% |

|

Limited or no understanding at all |

19% |

Estimated annual cost of tuition:

|

$1-$2,999 |

8% |

|

$3,000-$5,999 |

17% |

|

$6,000-$9,999 |

20% |

|

>$10,000 |

22% |

|

I don't know |

27% |

|

I don't remember |

6% |

|

Mean |

$8,538 |

Estimated monthly living expenses, excluding tuition:

|

$1-$499 |

19% |

|

$500-$999 |

13% |

|

$1,000-$1,499 |

12% |

|

>$1,500 |

14% |

|

I don't know |

37% |

|

I don't remember |

5% |

|

Mean |

$1,333 |

Of those planning post-secondary education for their children: Have they started to save?

|

Yes |

80% |

|

No |

18% |

|

I don't know |

2% |

Of those saving: How old were their children when they started to save?

|

Under 12 months old |

40% |

|

1-3 years old (while in daycare) |

23% |

|

4-5 years old (while in kindergarten) |

13% |

|

6-13 years old (while in elementary school) |

16% |

|

14-18 years old (while in high school) |

5% |

|

Don't remember |

3% |

Of those saving: How do they save? (multi choice)

|

Registered Education Savings Plan (RESP) |

76% |

|

Savings account |

26% |

|

Tax-free savings account (TFSA) |

16% |

|

Investments (e.g. in stocks, bonds) |

15% |

|

Other |

10% |

|

I don't know |

1% |

True or False? Knowledge of Registered Educations Savings Plans (RESPs) among those planning post-secondary education for their children

|

"This is true" |

"This is false" |

The correct answer is: | |

|

Every child needs their individual RESP |

54% |

46% |

False |

|

Money saved in an RESP can only be used for tuition |

45% |

55% |

False |

|

RESP contributions are tax deductible |

53% |

47% |

False |

|

There is no maximum lifetime contribution limit |

47% |

53% |

False |

|

The last year to make an RESP contribution is the year the child turns 17 |

65% |

35% |

False |

|

The federal government provides an annual grant of 20% of the first $2,500 of annual contributions |

82% |

18% |

True |

|

If I can't make the full contribution in one year, I can make it up in another year |

69% |

31% |

True |

|

To receive the grant, I must complete a separate government grant application |

63% |

37% |

True |

Of those with children currently completing or having completed post-secondary education:

Did post-secondary education cost more or less than expected?

|

More than expected |

39% |

|

What I expected |

50% |

|

Less than expected |

3% |

|

I don't know |

7% |

Of those saying it cost more than expected, what would they have done differently (multi choice, top 5):

|

Start saving earlier |

46% |

|

Explore student loans and scholarships |

27% |

|

Discuss desired jobs and income prospects with children |

17% |

|

Spend less on discretionary expenses |

13% |

|

Talk to an advisor to get help building a plan |

12% |

|

I don't know |

16% |

2016 CIBC Cost of Education Poll Disclaimer

From August 19-24, 2016, an online survey was conducted among 1,004 randomly selected Canadian adults who are Angus Reid Forum panellists with children in the household planning on attending, are currently attending or have attended a post-secondary institution in the past 24 months. The margin of error - which measures sampling variability - is +/- 3.0 per cent, 19 times out of 20.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking and business clients. Through our three major business units - Retail and Business Banking, Wealth Management and Capital Markets - CIBC offers a full range of products and services through its comprehensive electronic banking network, branches and offices across Canada with offices in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/ca/media-centre/ or by following on Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

SOURCE Canadian Imperial Bank of Commerce

Image with caption: "Three out of five Canadian parents don't seem to grasp the actual cost of tuition fees for college or university, a new poll by CIBC finds. That makes it hard to budget and build a savings plan for their children's post-secondary education. (CNW Group/Canadian Imperial Bank of Commerce)". Image available at: http://photos.newswire.ca/images/download/20160901_C4686_PHOTO_EN_764258.jpg