Canadians will dip into 'cash and savings' and spend on average $11,800 to hammer down on 'wear and tear'

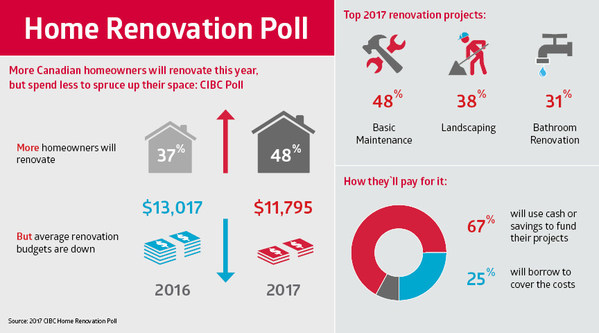

TORONTO, May 30, 2017 /CNW/ - With average household debt and housing prices at record highs across Canada, a new poll by CIBC (CM:TSX) (CM:NYSE) finds that a growing number of Canadian homeowners (48 per cent) are choosing to renovate this year, but are spending less to do so. Homeowners will spend $11,800 on average – the lowest in three years – to address 'wear and tear' and basic home maintenance, like painting, flooring, and replacing appliances.

Further, as many as 56 per cent of homeowners who plan to renovate are choosing to stay put and spruce up their space instead of selling their current home and buying another.

Key poll findings:

- 48 per cent of Canadian homeowners intend to repair or improve their home this year, up from 37 per cent in 2016. Among those planning to renovate this year:

- $11,800 is the average they plan to spend on their renovation, down from roughly $13,000 last year

- Homeowners in Ontario and British Columbia plan to spend the most at $16,000 and $13,200, respectively

- Homeowners in Ontario and British Columbia plan to spend the most at $16,000 and $13,200, respectively

- 56 per cent are choosing to renovate instead of selling and buying a new home

- The primary reason to renovate is to address 'wear and tear', with a third (32 per cent) saying they 'need to do repairs'; another quarter (25 per cent) 'want to make their home look nice', and 12 per cent want to increase the value of their home to sell.

- Top renovation projects include basic maintenance (48 per cent); landscaping (38 per cent); and bathroom renovations (31 per cent).

- 67 per cent will use cash or savings to fund their projects, while 25 per cent will cover the costs with a loan, line of credit or credit card

- $11,800 is the average they plan to spend on their renovation, down from roughly $13,000 last year

"These findings show that the decision to either renovate or relocate comes down to your financial situation, emotional attachment to your home, and ultimate real estate goals," says Scott McGillivray, renowned real estate investor, contractor and television personality. "While moving into a new home can help address your need for space, a renovation can often help achieve the same goal, while keeping you in your neighbourhood and, if done right, adding value to your home. Do your research first by speaking with your realtor, a trusted contractor and your financial adviser. Expert advice can help you determine which option best fits your needs and your budget."

Biggest irritants and worries

Not surprisingly, the poll finds homeowners about to embark on renovations are most worried about project delays, household disruption and overspending. While the majority (86 per cent) agree 'renovations end up costing more than you plan for' and 31 per cent admit they blew their budget on a previous project, almost two-thirds (61 per cent) of those planning to renovate this year don't have a detailed budget for their upcoming project.

"Renovations can be stressful, but having a detailed budget can help minimize the disruption and keep your project on track," says Scott Wambolt, Senior Vice President, Retail and Business Banking, CIBC. "Be clear about the goals and limits of your project as well as the costs before you head over to the hardware store or pick up your toolbox. While DIY can add up to some cost savings, it could end up costing you more if you don't know what you're doing."

The trick is to make sure your small fix doesn't turn into a bigger project than you'd planned for and cost you more than you bargained for in time or money, he adds.

Regional spenders

Among those planning to renovate, homeowners in Ontario and British Columbia plan to spend the most, at $16,000 and $13,200, respectively, funded mainly by cash or savings. While spending is lower in Quebec at $8,400, as many as a third (32 per cent) say their project will add to their debt.

The poll findings also reveal that fewer Boomers (36 per cent) plan to renovate than younger Canadians, but they will spend nearly twice as much at $16,800, with the bulk of it being spent on home repairs (45 per cent) or landscaping (34 per cent). This group was also more likely to cite "increasing the value of their home to sell" as a primary purpose for undertaking the project.

"Renovations can be a great way to invest in your home. When done right they can make a home more functional, more energy efficient, and they're a great way to freshen up a tired space," says Mr. McGillivray. "Just be sure any upgrades are in keeping with the quality of the rest of the neighbourhood, especially if your goal is to add value to your home and/or recover the cost when you sell."

CIBC's Home Renovation Checklist can help homeowners with valuable tips and advice to keep their project on track.

Tips for less stressful renovation:

- Plan for what will (and won't) be part of your project

- Know if you will live out or live-through your renovation

- Create a budget – and stick to it!

- DIY what you know

- Hire a professional for what you don't

KEY POLL FINDINGS:

Percentage of all Canadians homeowners who plan to renovate in the next 12 months:

|

2017 |

2016 |

2015 |

|

|

National |

48 % |

37 % |

40 % |

Average spend for Canadian homeowners who plan to renovate:

|

2017 |

2016 |

2015 |

|

|

Average amount |

$11,795 |

$13,017 |

$12,293 |

|

$1 to $4,999 |

29 % |

27 % |

23 % |

|

$5,000 to $9,999 |

24 % |

20 % |

20 % |

|

$10,000 to $14,999 |

12 % |

15 % |

16 % |

|

$15,000 to $24,999 |

9 % |

9 % |

11 % |

|

$25,000 or more |

9 % |

10 % |

9 % |

|

I don't know |

16 % |

19 % |

21 % |

Average spend for Canadian homeowners who plan to renovate, by province/region:

|

2017 |

2016 |

2015 |

|

|

National |

$11, 795 |

$13,017 |

$12,293 |

|

BC |

$13,188 |

$15,522 |

$16,639 |

|

AB |

$7,351 |

$22,952 |

$13,520 |

|

MB/SK |

$8,288 |

$7,709 |

$9,516 |

|

ON |

$15,988 |

$13,878 |

$15,488 |

|

QC |

$8,445 |

$7,933 |

$5,992 |

|

Atlantic |

$9,212 |

$10,837 |

$7,964 |

How Canadian homeowners who plan to renovate will fund their renovation projects:

|

Cash or savings |

67 % |

|

Line of credit or loan |

10 % |

|

Credit card |

8 % |

|

Home equity line of credit |

7 % |

|

Insurance claim/pay out |

1 % |

|

Other or I don't know |

6 % |

Top five planned home renovations for Canadian homeowners who plan to renovate:

|

2017 |

2016 |

2015 |

|

|

Basic maintenance (including painting, flooring, general repairs, replacing appliances) |

48 % |

54 % |

55 % |

|

Landscaping (including outdoor deck, patio, driveway) |

38 % |

42 % |

25 % |

|

Bathroom renovations |

31 % |

33 % |

40 % |

|

Kitchen renovations |

26 % |

26 % |

31 % |

|

Replacing windows or doors |

23 % |

23 % |

- |

Primary purpose for renovations for Canadian homeowners who plan to renovate (top five):

|

Address wear and tear (I need to do repairs) |

32 % |

|

Purely cosmetic (I want my home to look nice) |

25 % |

|

Increase the value of my home (I'm looking to sell in the future) |

12 % |

|

Full scale renovation/addition (I want my home to better meet my needs) |

7 % |

|

Personal enjoyment (I like doing handiwork and home projects) |

7 % |

CIBC Home Renovation Poll Disclaimer:

From May 10th to May 14th 2017 an online survey was conducted among 2,068 Angus Reid Forum panellists who are Canadian adult homeowners. The margin of error—which measures sampling variability—is +/- 2.2%, 19 times out of 20. The results have been statistically weighted according to education, age, gender and region (and in Quebec, language) Census data. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking and business clients. Through our three major business units - Retail and Business Banking, Wealth Management and Capital Markets - CIBC offers a full range of products and services through its comprehensive electronic banking network, branches and offices across Canada with offices in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/ca/media-centre/ or by following on LinkedIn (www.linkedin.com/company/cibc), on Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

SOURCE CIBC