Despite concerns, the majority plan to invest in innovation in year ahead

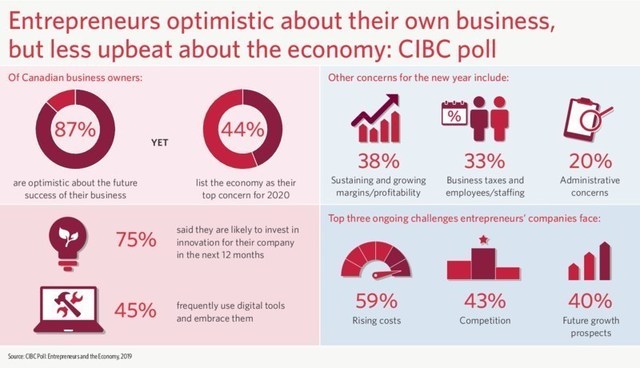

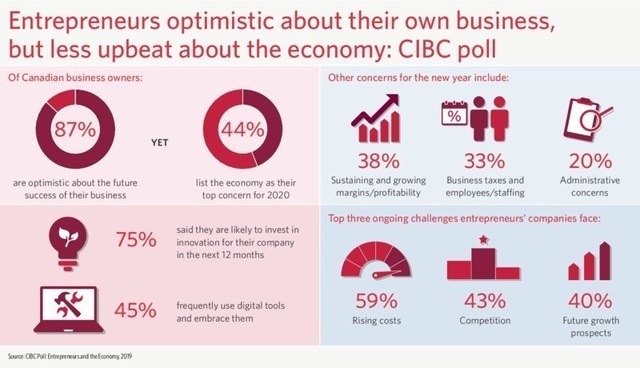

TORONTO, Oct. 31, 2019 /CNW/ - A new poll of Canadian entrepreneurs and business owners finds that nearly nine-in-10 (87 per cent) are optimistic about the future success of their business; but when it comes to the economy overall, they are far less upbeat, with 44 per cent listing it as their top concern for 2020. The CIBC Business Optimism Survey, a poll of 1,005 business owners across the country, probed entrepreneurs on issues pertaining to the economy, their business and innovation.

"Canadian entrepreneurs are building financial security with 74 per cent telling us their current financial situation is much better than before forming their business," said Andrew Turnbull, Senior Vice-President, Business Banking, CIBC. "But some worry about what's ahead for the economy with 44 per cent of entrepreneurs listing it as a top 2020 concern."

Other concerns for the new year include:

- Sustaining and growing margins/profitability - 38 per cent

- Business taxes and employees/staffing - 33 per cent

- Administrative concerns - 20 per cent

- Regulatory/trade obstacles - 17 per cent

When asked about the top five ongoing challenges their organization faces, entrepreneurs listed rising costs (59 per cent), competition (43 per cent), future growth prospects (40 per cent), HR and talent (39 per cent) and managing cash flow (32 per cent).

"Every entrepreneur faces unique challenges for their particular business, but the commonality of rising costs and heightened competition necessitate innovation to stay ahead of their industries whether it is to elevate customer experience or to create business efficiencies," said Mr. Turnbull.

Innovation investments on the horizon

Three quarters of business owners (75 per cent) said they were "likely to invest in innovation for their company" in the next 12 months.

When asked what innovation means to them, the three top answers stood out from the rest: "being able to evolve my business to meet my customers' changing needs" (26 percent), followed by using "new methods or technologies to achieve efficiencies" (23 per cent) and "providing service in a better or more differentiated way" (14 per cent).

When asked about adoption of digital tools and digitally-enabled services to help manage and grow their business, entrepreneurs said they:

- Frequently use digital tools and embrace them - 45 per cent

- Sometimes use digital tools, but only when they need to - 32 per cent

- Use digital tools in almost every aspect of their life, and try new digital apps/digital ways of doing things - 14 per cent

- Rarely use digital tools and avoid them whenever they can - nine per cent

"CIBC is committed to a vibrant, globally competitive business economy in Canada. We are focused on investments in innovation to help our clients achieve business growth," said Mr. Turnbull. "One of the ways we are looking to help business owners is with leading banking tools and solutions including CIBC SmartBanking™ for Business."

Introduced earlier this year, CIBC SmartBanking for Business is a first-of-its-kind platform providing business owners and their authorized team members with an integrated banking, accounting and payroll experience using secure data integration with leading cloud service providers. By simplifying weekly bookkeeping, as well as providing integrated cash flow insights and business analysis tools, CIBC SmartBanking for Business is giving time back to business owners to focus on their own innovation and competitiveness in today's rapidly-evolving economy.

About the CIBC Small Business Optimism Survey

From August 8th to August 18th 2019 an online survey of 1,005 Canadian Small Business Owners who are Maru Voice Business Canada panelists was executed by Maru/Blue. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 3.1%, 19 times out of 20. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 10 million personal banking, business, public sector and institutional clients. Across Personal and Small Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/en/about-cibc/media-centre.html.

SOURCE CIBC