Poll reveals most Canadians envision saving enough money to choose their retirement date, however optimism fades as retirement approaches

TORONTO, Oct. 6, 2011 /CNW/ - Canadians anticipate saving enough to retire at age 63, and most see themselves entering retirement without debt according to a new CIBC (TSX: CM) (NYSE: CM) poll conducted by Harris/Decima. However, the poll also shows that as Canadians draw closer to retirement they become less optimistic about reaching their savings goals and see it as more likely they'll carry at least some debt into retirement.

Findings of the poll include:

- On average, Canadians believe they will retire at age 63

- When asked why they would ultimately retire, the most popular answer among Canadians was that they will have saved enough money to choose their retirement date (37 per cent)

- Only 22 per cent of Canadians believe they will carry some debt into retirement - however past CIBC research shows that among retired Canadians, 54 per cent hold some form of debt

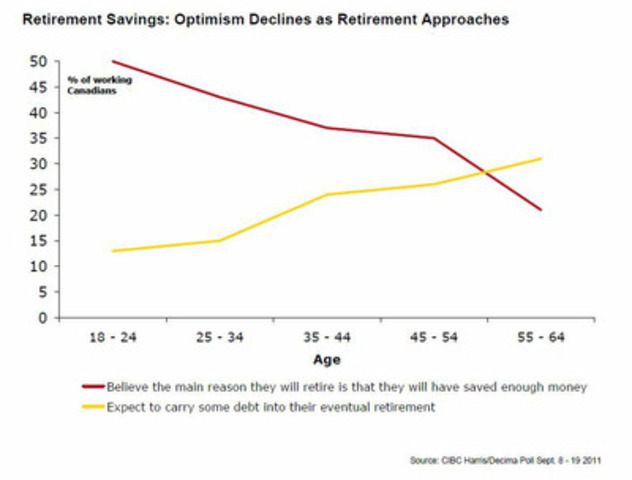

- Boomers on the verge of retirement in the 55 to 64 year old age group were less likely to believe they would be able to choose to retire based on their savings (only 21 per cent), and more likely to believe they would carry debt into retirement (31 per cent)

"Our CIBC Poll shows that Canadians set out with a vision of building up their savings and eliminating debt to retire at a time of their choosing, but with each passing year they feel less optimistic about their plans," said Christina Kramer, Executive Vice-President, Retail Distribution and Channel Strategy, CIBC. "These findings demonstrate the importance of having a plan in place and making progress towards your goals every year, to give you the flexibility to make choices about when and how you retire."

A key finding of the poll is that as Canadians near retirement, their optimism in reaching their savings goals for retirement drops:

- For example, 43 per cent of Canadians aged 25-34 feel they will be able to choose to retire based on the savings they will accumulate over their working life

- However, for those at the leading edge of the baby boom (aged 55-64) that number is cut in half to just 21 per cent

"As Canadians get closer to retirement, many are finding they have not achieved the retirement savings goals they set for themselves, which could lead to Canadians either working longer than they anticipated, or making adjustments to their retirement such as reducing expenses to stretch their income further," added Ms. Kramer.

Canadians also see their debt being repaid by the time they retire, but as retirement draws closer this also is viewed as somewhat less likely:

- For example, only 15 per cent of those in the 25-34 age group believe they'll carry any debt into retirement

- That number doubles to 31 per cent for those 55-64 years of age.

Past CIBC polls show that Canadians believe they will be debt free by age 55, but many don't reach this target. As debt is carried closer to Canadians' target retirement age of 63 outlined in this poll, it can restrict the cash flow available for savings and may lead to Canadians missing the savings goals they have set for themselves.

"Your finances are all connected, meaning the more effective you are at debt management, the more funds you have available to accelerate savings for retirement," commented Ms. Kramer. "Sitting down with an advisor to map out a strategy that addresses both your savings and debt management plans is an integral step to achieving your long term savings goals and enjoying the retirement you want."

KEY POLL FINDINGS

Average age at which Canadians expect to retire:

National Average - Age 63

Atlantic Canada - Age 62

Quebec - Age 62

Ontario - Age 63

Manitoba/Saskatchewan - Age 63

Alberta - Age 62

BC - Age 64

Percentage of Canadians, by age, who believe the main reason they will retire is that they will have saved enough money to do so:

Age 18-24 - 50 per cent

Age 25-34 - 43 per cent

Age 35-44 - 37 per cent

Age 45-54 - 35 per cent

Age 55-64 - 21 per cent

Percentage of Canadians by age who expect to carry some debt into their eventual retirement:

Age 18-24 - 13 per cent

Age 25-34 - 15 per cent

Age 35-44 - 24 per cent

Age 45-54 - 26 per cent

Age 55-64 - 31 per cent

Each week, Harris/Decima interviews just over 1000 Canadians through teleVox, the company's national telephone omnibus survey. These data were gathered in a sample of 1,116 employed Canadians and 683 retired Canadians between September 8th and 19th, 2011. A sample of this size has a margin of error of +/-2.9% and 3.7% respectively, 19 times out of 20.

CIBC (CM: TSX;NYSE) is a leading North American financial institution with nearly 11 million personal banking and business clients. CIBC offers a full range of products and services through its comprehensive electronic banking network, branches and offices across Canada, and has offices in the United States and around the world. You can find other news releases and information about CIBC in our Press Centre on our corporate website at www.cibc.com.

Image with caption: "Retirement Saviings: Optimism Declines as Retirement Approaches (CNW Group/CIBC)". Image available at: http://photos.newswire.ca/images/download/20111006_C9787_PHOTO_EN_4182.jpg

Kevin Dove, Senior Director, External Communications and Media Relations: (416) 980-8835 or Kevin.dove@cibc.ca