With only 22 per cent of boomers formalizing their wishes, families are putting off having important conversations, underscoring the need for a family playbook

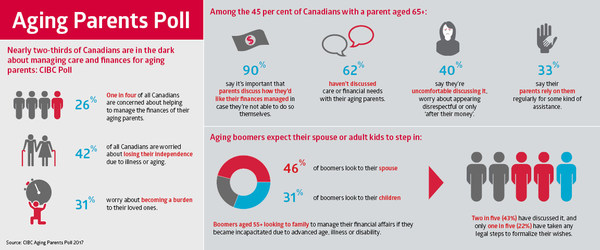

TORONTO, April 27, 2017 /CNW/ - While the vast majority of Canadian adults with a parent over the age of 65 feel it's important to discuss elder caregiving and financial support, nearly two-thirds (62 per cent) admit they have not yet had that conversation mainly because it makes them uncomfortable, a new CIBC (TSX: CM) (NYSE: CM) poll finds.

"Families shouldn't wait for a health emergency or unexpected event to force a hurried conversation about caregiving and financial planning," says David Nicholson, Vice-President, CIBC Imperial Service. "These can be tough conversations, but creating a family playbook with clear plans and expectations can help reduce the emotional and financial strain to ensure everyone feels well-prepared for the years ahead."

Key poll findings:

- One in four (26 per cent) of all Canadians are concerned about helping to manage the finances of their aging parents. That jumps to a third (31 per cent) for those aged 35-54.

- As many as 42 per cent of all Canadians are worried about losing their independence due to illness or aging and 31 per cent worry about becoming a financial burden to their loved ones.

- Among the 45 per cent of Canadians with a parent aged 65+:

- 90 per cent say it's important that parents discuss how they'd like their finances managed in case they're not able to do so themselves

- Almost two-thirds (62 per cent) have not had a conversation with their parents about how to manage their financial affairs in case they aren't able to do so on their own

- Two-in-five (40 per cent) say they're uncomfortable discussing it, or worry about appearing disrespectful or only 'after their money'

- 73 per cent believe it's really up to their parents to start the conversation

- One-third (33 per cent) say their parents rely on them regularly for some kind of assistance.

With nearly one in six Canadians at least 65 years old in 2015 and the growth rate accelerating as the baby boomer generation ages, elder care and financial planning is becoming a growing issue for Canadian families, says Mr. Nicholson.

Aging boomers expect their adult kids to step in

The poll results also reveal that 46 per cent of boomers aged 55+ expect their spouse and 31 per cent look to their children to manage their financial affairs if they became incapacitated due to advanced age, illness or disability. That said, the vast majority (89 per cent) with children, who expect their spouse to take care of them, also want their adult kids to be prepared to step in to provide care and financial support if needed.

Yet, only two in five (43 per cent) of boomers have actually discussed it, and even fewer (22 per cent) have taken any steps to formalize their wishes because they haven't made time for it, don't think they need to, or feel they don't have enough wealth to warrant planning ahead.

"An outside expert or professional can help facilitate a family dialogue around what can otherwise be a tough conversation and help you create a financial plan that meets your needs and ensure your have the proper documents in place," says Mr. Nicholson. "You don't want anyone to scramble trying to find important documents, pay bills, or be unsure of what their mom or dad would've wanted."

"Now is the time to have that heart-to-heart and put the right documents in place. A little bit of planning early on goes a long way and will help you provide your parents with the care and support they provided you," he says.

A will won't cover everything

The poll also finds that some Canadians with parents aged 65+ know they already have the power to provide financial or personal support, and others don't. Less than half (43 per cent) of adult kids say their parents have either a Power of Attorney (POA) or Mandate in Quebec, or a personal care POA in place, compared to 68 per cent who say their parents have a will.

While a will is often the initial step and an effective tool in your estate plan, the planning shouldn't end there, adds Mr. Nicholson.

With Canadians on average living longer, the likelihood of needing some help with banking, health or personal care is something many families will need to consider, especially for those at risk of debilitating cognitive diseases which could leave them vulnerable to fraud or abuse.

"It's important to appoint someone you trust to tend to your health, personal care and finances," says Mr. Nicholson. "Providing them with instructions and a financial plan for your senior years, will help you age with confidence knowing your needs will be met."

Five steps to creating your family playbook:

- Have a conversation – include all or key family members to minimize any confusion or family conflict later

- Know where to find key documents and financial assets - Build a file with contact names and key documents, such as medical, legal and financial documents, including bank accounts, safety deposit boxes, investments, insurance, recent income tax returns, business interests, assets, liabilities, financial and personal care POAs. List your monthly bills/expenses.

- Write down plans and expectations for caregiving

- Create a financial plan that considers caregiving arrangements and costs

- Seek financial and legal counsel about building your estate plan

Click here for more information about creating your family playbook.

KEY POLL FINDINGS:

Percentage of Canadians who strongly agree or somewhat agree with the following statements:

|

All |

55+ |

|

|

It's important that parents discuss how they'd like their finances managed in case |

90 % |

91 % |

|

It's important to take legal steps to ensure my wishes are documented and carried out |

88 % |

92 % |

|

It's the parent's responsibility to initiate a conversation and provide direction on how |

73 % |

74 % |

|

Thinking of myself, I'm comfortable disclosing details of my personal finances with my |

71 % |

77 % |

|

My parent's finances are none of my business and have no effect on my financial |

59 % |

54 % |

|

I'm concerned that discussing financial and care needs will cause family conflict |

36 % |

31 % |

|

My parents regularly rely on my for some kind of assistance |

33 % |

36 % |

|

It's unnecessary to prepare – people just figure it out when the time comes |

21 % |

17 % |

Top five concerns among Canadians as they age:

|

All |

Canadians |

|

|

Managing unexpected health-related expenses and long-term care |

45% |

47% |

|

Losing financial independence (relying on others to manage my finances, |

42% |

44% |

|

Becoming a burden to my loved ones |

31% |

32% |

|

Myself or my parents becoming a victim of fraud or abuse |

28% |

31% |

|

Helping to manage the care of my aging parents/spouse's parents |

26% |

33% |

Percentage of Canadians identifying who they want to manage their finances when they're no longer able to do so independently:

|

All |

55+ |

|

|

My spouse/partner |

47 % |

46 % |

|

One or all of my children |

18 % |

31 % |

|

My sibling or other family member |

15 % |

10 % |

|

Other (i.e. friend, lawyer, accountant, trust company) |

4 % |

5 % |

|

I haven't thought about it |

17 % |

8 % |

Percentage of Canadians who have had a conversation or formalized arrangements with the person they would like to manage their finances in the event they are unable to do so themselves:

|

All |

55+ |

|

|

Yes, I've spoken with everyone involved |

26 % |

36 % |

|

Yes, I've spoken with some people, but not everyone |

9 % |

7 % |

|

Yes, I've written down my wishes and stored them in a safe place |

4 % |

6 % |

|

Yes, I have legal documents in place |

12 % |

22 % |

|

No, I haven't, but it's probably a good idea |

34 % |

23 % |

|

No |

14 % |

7 % |

Percentage of Canadians who say their parents aged 65+ have the following in place:

|

Yes |

No |

I don't know |

|

|

A written financial plan for senior years |

23 % |

39 % |

38 % |

|

Estate Plan |

32 % |

33 % |

35 % |

|

Legal Power of Attorney (of Mandate) |

43 % |

25 % |

32 % |

|

Healthcare Power of Attorney |

39 % |

27 % |

34 % |

|

A written legal will |

68 % |

14 % |

18 % |

|

A trust |

19 % |

46% |

36 % |

|

Advanced care plan or healthcare proxy |

29 % |

34 % |

37 % |

CIBC Aging Parents Poll:

From March 16th to March 20th 2017 an online survey was conducted among 3,034 randomly selected Canadian adults who are Angus Reid Forum panellists. The margin of error—which measures sampling variability—is +/- 1.7%, 19 times out of 20. The results have been statistically weighted according to education, age, gender and region (and in Quebec, language) Census data to ensure a sample representative of the entire adult population of Canada. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking and business clients. Through our three major business units - Retail and Business Banking, Wealth Management and Capital Markets - CIBC offers a full range of products and services through its comprehensive electronic banking network, branches and offices across Canada with offices in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/ca/media-centre/ or by following on LinkedIn (www.linkedin.com/company/cibc), Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

SOURCE CIBC