Bank partners with fintech Borrowell and Equifax Canada to take mobile banking beyond transactions

TORONTO, June 2, 2017 /CNW/ - CIBC (TSX: CM) (NYSE: CM) To help clients build a better understanding of their overall financial well-being, CIBC is working with leading fintech Borrowell and Equifax Canada to provide Canadians unlimited free access to their educational credit score through CIBC mobile banking, anywhere, anytime.

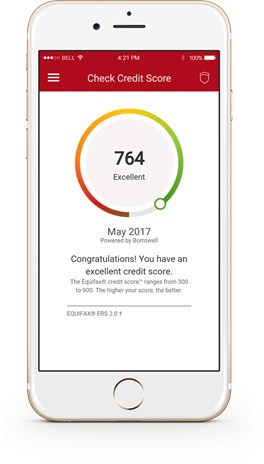

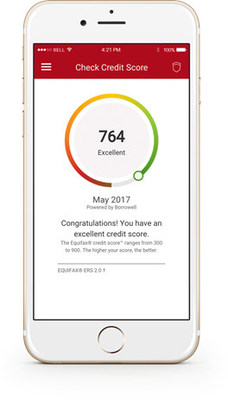

Available through the CIBC Mobile Banking App, clients can access their Equifax credit score which will be updated quarterly, allowing them to track their financial standing over time. In addition, they will have access to important information on factors that affect a credit score and advice on how to improve it.

"As we continue building a personalized digital banking experience for clients, we are also delivering technology that can help clients make informed financial decisions when, where and how they want," says Aayaz Pira, Senior Vice President, CIBC Digital, Retail and Business Banking. "With a simple tap on their mobile banking app, clients can easily access their credit score, allowing them to have a full-picture of their overall credit health, and better control of their finances."

Recent CIBC research reveals that the majority of Canadians recognize the importance of knowing their credit score to safeguard against fraud, yet more than two-thirds do not know their credit score (69 per cent). Two-in-five (45 per cent) say they have no idea where to obtain their credit score.

Using Borrowell's online platform drawing on credit bureau data compiled by Equifax, CIBC's safe and secure Free Credit Score service is considered a "soft" credit inquiry, meaning it won't negatively impact a client's overall score. This speaks directly to almost half of Canadians (49 per cent) who said they fear checking their score will result in negative implications on their credit.

"Knowing your credit score is important, particularly if you're planning to purchase a new home or car, or if you are new to Canada and working to establish your credit," says Bijal Patel, Executive Vice President, Products, Retail & Business Banking, CIBC. "Clients can better plan for the future by having an up-to-date view of their credit score and then start a conversation with an advisor to help them achieve their goals."

Today's announcement furthers CIBC's commitment to broadening mobile banking beyond transactions. By adding mobile features that speak to a client's full financial picture, CIBC is taking a broader view of what mobile means to client relationships.

"There's no question clients look to mobile to get their routine banking transactions done quickly and conveniently," adds Pira. "Increasingly, clients also want a mobile banking experience that offers deeper insights into their overall finances keeping them connected to the big picture, and new services like free credit score make that a reality."

Launching on mobile first, free credit score will be available online for all CIBC clients later this year.

Poll Disclaimer

From March 29 to March 30 2017 an online survey was conducted among 1,517 randomly selected Canadian adults who are Angus Reid Forum panelists. The margin of error—which measures sampling variability—is +/- 2.5%, 19 times out of 20. The results have been statistically weighted according to education, age, gender and region (and in Quebec, language) Census data to ensure a sample representative of the entire adult population of Canada. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking and business clients. Through our three major business units - Retail and Business Banking, Wealth Management and Capital Markets - CIBC offers a full range of products and services through its comprehensive electronic banking network, branches and offices across Canada with offices in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/ca/media-centre/ or by following on Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

About Borrowell

Borrowell helps Canadians make great choices about their credit. With its free credit score monitoring, personal loans and product recommendations, Borrowell empowers Canadians to improve their financial well-being and be the hero of their credit. Borrowell was named by LendIt as one of six emerging companies globally "that has demonstrated the greatest potential to impact the future of consumer lending," and is shortlisted as a top "disruptor" in PwC's 2017 Vision to Reality awards.

SOURCE CIBC