Moms and dads worry their 'kids can't afford to make mistakes', yet three-quarters aren't talking about money regularly

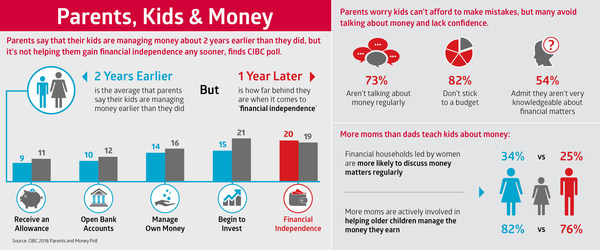

TORONTO, Oct. 23, 2018 /CNW/ - CIBC (CM:TSX) (CM:NYSE) – When it comes to managing money, kids are starting about two years earlier than their parents did, finds a new CIBC poll. Yet, most parents (73 per cent) avoid talking about money regularly and worry they lack the know-how, leaving their kids at risk of being underprepared to manage their finances effectively.

According to the poll, parents say that their kids open a bank account, get an allowance, manage their own money, get a credit card and become aware of their parents financial situation about two years earlier on average than they did. That gap widens to six years when it comes to investing with kids starting as early as 15 on average, while parents report starting much later at age 21.

Yet, despite earlier exposure to money, parents report their kids are no further ahead in achieving financial independence than they were. In fact, parents say kids are about a year behind them at age 20 versus 19.

"It's encouraging that parents are getting their kids on the right track early on, but setting your kids up for financial success is more than just opening a bank account and giving them money to manage on their own," says David Nicholson, Vice-President, CIBC Imperial Service. "It's also about having frequent conversations about money matters, which can be tough to do if you don't feel comfortable with your own finances."

While nearly all (93 per cent) respondents agree parents need to do a better job managing their own money to set a good example for their kids, the poll revealed that parents are struggling. More than two-thirds (67 per cent) admit they're only 'somewhat' following a budget at best, while 14 per cent don't have one at all. Further, almost half are currently carrying credit card debt (48 per cent).

Moreover, fewer than half of parents believe they're 'very knowledgeable' about household budgeting (46 per cent), saving (44 per cent) and debt management (39 per cent). Confidence drops significantly when it comes education planning (26 per cent) and falls to a mere 17 per cent on the topic of investing, with fewer women than men feeling confident about their fiscal know-how.

"We all want what's best for our kids, but we may not always model the best financial habits and behaviours," adds Mr. Nicholson. "You don't have to have all the answers, but seeking out expert advice together online or with your financial advisor can improve your family's financial literacy and confidence as a whole."

Moms take a leading role – 'Kids can't afford to make mistakes'

When it comes to teaching kids about money, the poll revealed that moms are taking the leading role. More financial households led by women than men say they regularly discuss money matters (34 per cent vs 25 per cent), and moms are more apt to discuss nearly every financial topic with their kids, including their own salary.

Moreover, more moms than dads are actively involved in helping older children manage the money they earn (82 per cent vs 76 per cent), despite both worrying that the stakes are high and 'kids can't afford to make mistakes' (71 per cent).

"It's important to empower kids to make informed decisions about money. Stay engaged in ongoing conversations and seek out strategies and tools that can help them reduce risk as they learn," says Mr. Nicholson. "For example, if your teenager is ready for a credit card, consider adding them as an authorized user to your own credit card with an assigned lower limit. This can help them learn healthy money habits – and avoid costly mistakes -- while they're still under your financial roof."

"When they reach legal age and can manage a credit card on their own, reinforce the importance of paying the balance in full each month to avoid interest charges and how late or missed payments can lead to a poor credit score which can limit their ability to reach other goals down the road," he adds.

Cash is king when it comes to allowances

When it comes to allowances, when, how and what to give varies among parents, but most believe it's important (80 per cent), and shell out about $91 each month on average to fund them. Only 13 per cent give allowance with no strings attached, while more than half (55 per cent) say their kids 'need to earn it' or are compensated occasionally in exchange for chores. Most parents hand over allowances in cash (75 per cent), while almost one in five (18 per cent) deposit the funds directly into a child's bank account.

While some budgeting and savings lessons stand the test of time, digital banking has radically changed how we manage money, says Mr. Nicholson. "Consider what new skills your kids need to manage their money online and responsibly use debit cards and mobile wallets," he adds. "Have them watch their account balance grow and shrink in real time after every deposit or purchase. You can also help them set up savings goals online where they can gain the satisfaction of watching the progress they're making as they work towards their goals."

Five money hacks for parents:

- Start early – It's never too early to start talking about money with your kids. Watch video.

- Save for their education – Set them up for success with a Registered Education Savings Plan to take advantage of the tax deferred accumulation of savings combined with the added benefit of government grants

- Be relevant and present – Kids of different ages need different money lessons, including how to manage their money and protect themselves online

- Empower them to make their own decisions – Help kids understand the value of money and tradeoffs so they can make informed decisions about how to spend their money. Online calculators for budgeting, investing and lending as well as credit spending alerts can help reduce the risk.

- Get help – Speak to a financial expert about ways to improve your financial health so you can model the best example for your kids

Key poll findings:

- On average, parents report that their kids are reaching major financial milestones earlier:

- 9 is the average age kids receive an allowance, while parents did so at age 11

- 10 is the average age kids open up bank account, while parents did so at age 12

- 14 is the average age kids begin to manage their own money, compared to parents at age 16

- 15 is the average age kids begin to invest, while parents started at age 21

- Yet, parents say their kids achieve financial independence at age 20, one year later than they did at age 19

- 71 per cent worry that the cost of living is so high that 'kids can't afford to make mistakes'

- 73 per cent of households don't regularly discuss financial matters

- Half (47 per cent) of parents say they were 'unprepared' when it came time to manage their own money

- 93 per cent agree 'parents need to do a better job managing their own money to set a good example for their kids'

- Among those with kids ages 7-18, the majority (80 per cent) give their kids allowance, dipping to 66 per cent among of those with young adults ages 19-24

About the CIBC Parents, Kids and Money Poll: From September 7th to September 11th, 2018 an online survey of 1,047 randomly selected Canadian parents (of children under the age of 25) who are Maru Voice Canada panelists was executed by Maru/Blue. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading Canadian-based global financial institution with 11 million personal banking, business, public sector and institutional clients. Across Personal and Small Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/en/about-cibc/media-centre.html or by following on LinkedIn (www.linkedin.com/company/cibc), Twitter @CIBC, Facebook (www.facebook.com/CIBC) and Instagram @CIBCNow.

SOURCE CIBC - Consumer Research and Advice