40 per cent concerned about their post-work lifestyle goals, with close to a quarter unable to contribute to retirement savings since COVID-19 began; CIBC hosting a free webinar in November to address need for retirement advice during the pandemic

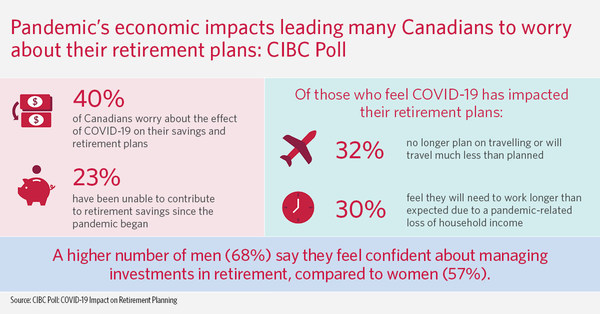

TORONTO, Oct. 22, 2020 /CNW/ - A recent CIBC survey finds that the pandemic has impacted Canadians' savings and their anticipated lifestyle in retirement. Four out of 10 (40 per cent) respondents worry about the effect of COVID-19 on their savings and retirement plans, with almost a quarter (23 per cent) unable to contribute to their retirement nest egg since the pandemic began.

Of those who feel COVID-19 has affected their retirement plans, many feel their expected vision for their post-work lives has changed. Almost a third (32 per cent) no longer plan on travelling or will travel much less than planned. Many Canadians also feel they will need to work longer than expected – for 30 per cent, this is due to a COVID-19-related loss of household income, and for 26 per cent, they feel the pandemic has significantly increased the cost of retiring. Additionally, out of those who intended to downsize their primary residence in their golden years, 40 per cent are now unsure of the right time to make this move.

A higher number of men (68 per cent) say they feel confident about managing investments in retirement, compared to women (57 per cent). Women are also more likely to turn to friends and family for retirement advice (25 per cent), whereas many men (23 per cent) claim they make all decisions about money matters on their own.

"This is a pivotal time to get advice about your ambitions for retirement," said Laura Dottori-Attanasio, Group Head, Personal and Business Banking. "An expert can help re-assess your financial plan, create new estimates for retirement income, identify ways to improve cash flow and adjust timelines if needed to meet your overall goals."

The survey also found:

- 26 per cent of those between the ages of 34-55 and 20 per cent of Canadians over the age of 55 have been unable to contribute to retirement savings since the pandemic began

- Of those who feel COVID-19 has affected their retirement plans, 24 per cent say the pandemic has made them realize they can live with less and will significantly reduce their discretionary spending in the long-term

- Lessons Canadians say they've learned during the pandemic include: there's a need to pay more attention to personal finances (20 per cent); not to panic when markets get volatile (21 per cent); and it's important to save for retirement/their future (19 per cent)

To help Canadians with retirement planning amidst the pandemic, CIBC is hosting a free webinar (in English and French) featuring a number of financial experts on November 3rd, 2020. For more information and to register, visit the website here.

Disclaimer

From August 19th to August 21st 2020 an online survey of 3,032 randomly selected Canadian adults who are Maru Voice Canada panelists was executed by Maru/Blue. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 1.6%, 19 times out of 20. The results have been weighted by education, age, gender and region (and in Quebec, language) to match the population, according to Census data. This is to ensure the sample is representative of the entire adult population of Canada. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading North American financial institution with 10 million personal banking, business, public sector and institutional clients. Across Personal and Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada with offices in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/en/about-cibc/media-centre.html.

SOURCE CIBC