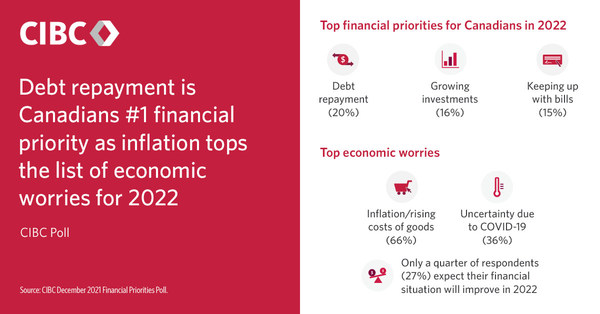

TORONTO, Dec. 29, 2021 /CNW/ - Almost two years into the global pandemic, CIBC's annual Financial Priorities poll finds that debt repayment is the number one goal for Canadians for 2022 (20 per cent), while economic worries are focused on inflation (66 per cent), followed by uncertainty due to COVID-19 (36 per cent).

With the rising costs of everyday items top-of-mind for many, among Canadians who say they took on more debt in 2021, 37 per cent said it was because expenses exceeded their monthly income. In the face of these concerns, only a quarter of respondents (27 per cent) expect their financial situation will improve next year.

"It's understandable that Canadians are concerned about the economy in 2022, but what's important is to have their personal financial house in order, if goods, services and carrying debt are going to cost more," said Carissa Lucreziano, Vice-President, CIBC Financial and Investment Advice. "Although a number of Canadians do not feel their finances will get better in 2022, most* have not had a planning session with their financial advisor in the last year. Making that a New Year's resolution can help Canadians manage their financial expectations – and any surprises - in 2022."

When asked what financial wellness means to them, 47 per cent of respondents say living without financial stress, and also said it was a top descriptor for overall wellness (28 per cent). Four in ten (41 per cent) feel financial wellness comes from being able to afford what they need in life, such as housing, food, or transportation. Half (50 per cent) admit that they wish they were better at saving, while a similar number of Canadians agree that they need to get a better handle on their finances this coming year (49 per cent).

"It is imperative to seek ways to mitigate financial stress, as it's clearly a key factor in overall wellness. Having a plan to reach your long term ambitions and a clear understanding of your monthly cash flow can significantly reduce stress, which is why we recommend seeking the help of a financial expert who can implement a plan to alleviate these pressures and get people on track to achieve their ambitions," added Lucreziano.

Additional findings from the 2021 December Financial Priorities poll:

- Other top financial priorities for 2022 are growing investments (16 per cent) and simply keeping up with bills (15 per cent).

- Common secondary financial goals for 2022 include saving as much as possible/growing an emergency fund (28 per cent), avoiding taking on more debt (26 per cent), saving for a vacation/travel (17 per cent), reducing discretionary spending (17 per cent), and saving for retirement (16 per cent).

- 80 per cent of Canadians expect that their financial goals will remain the same once the pandemic is over.

- When it comes to wellness, work-life balance is also important, with seven in ten (70 per cent) believing that maintaining a healthy work-life balance is now more important than ever.

- 40 per cent of homeowners and 31 per cent of non-homeowners are worried about rising interest rates.

- *70 per cent of respondents have not had a planning session with their financial advisor in the last year.

Upcoming virtual event

CIBC is hosting free webinars (in English and French) on January 27th featuring CIBC Deputy Chief Economist Benjamin Tal and CIBC Chief Investment Officer Luc de la Durantaye, who will share their insights about the Canadian and global economies and what it means for personal finances.

Tools and support

In addition to expert, personalized advice, CIBC also offers clients the following tools to help manage their everyday expenses and overall finances:

- Budget Calculator, which offers a clear picture of monthly cash flow to guide making financial decisions.

- CIBC Goal Planner, an intuitive tool to map out and easily adjust goals as they evolve over time.

- CIBC Insights, with tips and proactive alerts about everyday spending to make it easier to manage money and understand how transactions are tracking toward goals.

Disclaimer

From December 6 to December 7, 2021 an online survey of 1,515 randomly selected Canadian adults who are Maru Voice Canada panelists was executed by Maru/Blue. For comparison purposes, a probability sample of this size has an estimated margin of error (which measures sampling variability) of +/- 2.5%, 19 times out of 20. The results have been weighted by education, age, gender and region (and in Quebec, language) to match the population, according to Census data. This is to ensure the sample is representative of the entire adult population of Canada. Discrepancies in or between totals are due to rounding.

About CIBC

CIBC is a leading North American financial institution with 11 million personal banking, business, public sector and institutional clients. Across Personal and Business Banking, Commercial Banking and Wealth Management, and Capital Markets businesses, CIBC offers a full range of advice, solutions and services through its leading digital banking network, and locations across Canada, in the United States and around the world. Ongoing news releases and more information about CIBC can be found at www.cibc.com/ca/media-centre.

SOURCE CIBC